GCash extends grace period and waives late penalty fees for typhoon-hit borrowers

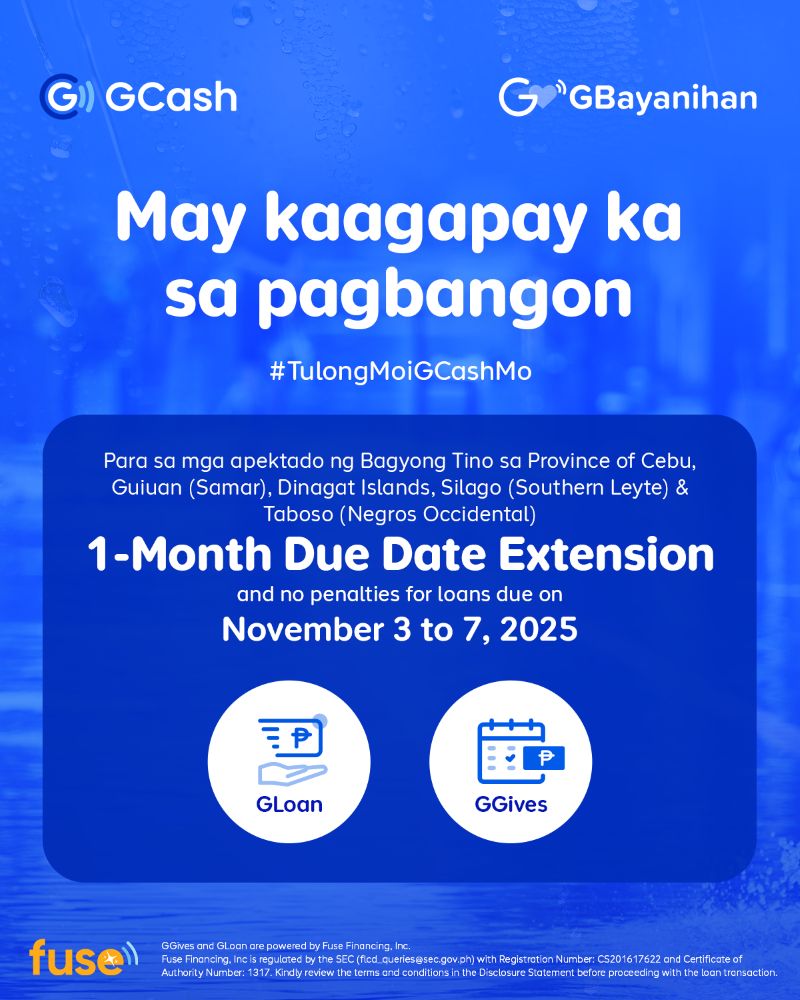

Philippines’ leading super finance app, GCash, through official lending arm Fuse Financing Inc., is extending a 30-day due date extension for GLoan and GGives borrowers impacted by Typhoon Tino.

This applies to borrowers whose loans are due between November 5 and 7, 2025 and residing in areas hardest hit by the typhoon: Guian (Samar), Cebu City, North Cebu, South Cebu, Dinagat Islands, Silago, Southern Leyte, and Toboso, Negros Occidental.

Eligible accounts will automatically receive a one-month due date extension. For example, a loan originally due on November 5 will now be due on December 5. During this period, Automatic Debit Arrangement feature will be temporarily disabled, allowing customers to prioritize emergency needs and recovery. No additional interest, late fees, or penalties will be charged during the extension period.

Eligible borrowers will also receive SMS notifications detailing their new due dates and guidance on managing repayments. Other locations may be included as the government declares additional areas under a state of calamity. Customers with clarifications can file a ticket through GCash Help Center or talk to Gigi inside the GCash App.

About GCash

GCash is the Philippines’ #1 Finance Super App and Largest Cashless Ecosystem. Through the GCash App, users can easily purchase prepaid airtime; pay bills via partner billers nationwide; send and receive money anywhere in the Philippines, even to other bank accounts; purchase from over 6 million partner merchants and social sellers; and get access to savings, credit, loans, insurance and invest money, and so much more, all at the convenience of their smartphones. Its mobile wallet operations are handled by G-Xchange, Inc. (GXI), a wholly-owned subsidiary of Mynt, the first and only $5 billion unicorn in the Philippines.

GCash is a staunch supporter of the United Nations Sustainable Development Goals (SDGs), particularly UN SDGs 5,8,10, and 13, which focus on safety & security, financial inclusion, diversity, equity, and inclusion as well as taking urgent action to combat climate change and its impacts, respectively.

About Fuse Financing, Inc.

Fuse Financing, Inc. is a company that offers simple, affordable, and secure loans in the Philippines. Its primary goal is to enable individuals and small businesses to achieve financial security and growth through various digital lending products. Fuse Financing is a wholly-owned subsidiary of Mynt, the first and only $5 billion unicorn in the Philippines. It’s also regulated by the Securities and Exchange Commission (SEC).

Mynt, through its fintech operations, is a staunch supporter of the United Nations Sustainable Development Goals (SDGs), particularly UN SDGs 5,8,10, and 13, which focus on safety & security, financial inclusion, diversity, equity, and inclusion as well as taking urgent action to combat climate change and its impacts, respectively.

Average Rating